-

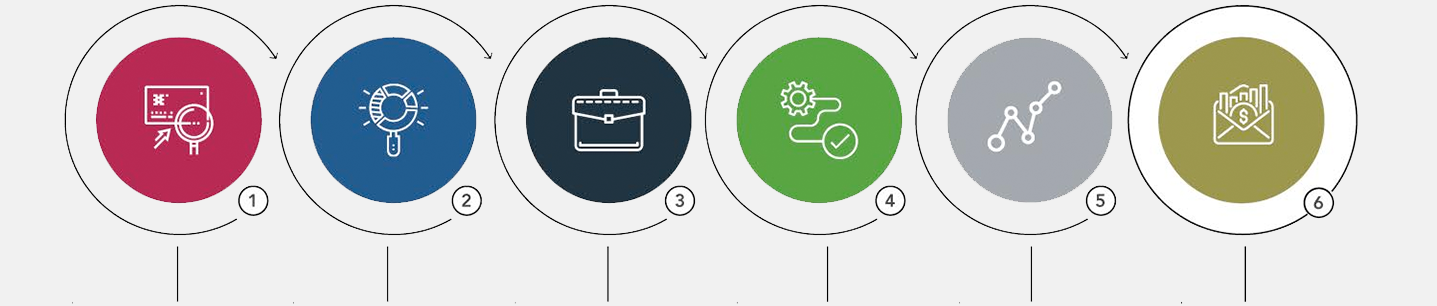

Know your

Clients

Identify the client’s investment objectives taking into consideration: goals, return objective, risk tolerance, age, income, occupation and time horizon

Assign a strategy accordingly

-

research

analysis

Top down analysis: Comprehensive coverage of global economies to identify industries that are likely to outperform the market

Bottom up analysis: Exhaustive analysis is conducted through a screening model to identify fundamentally strong companies with attractive upside potential

-

portfolio

construction

Using the client's profile as a guideline, a portfolio is constructed and backtested to ensure that client objectives are achieved

The portfolio is constructed in line with the approved investment strategy, which is consistent with the views of the Bank's Investment Committee

-

execution

Trade quantities and limit orders are posted in our brokerage platform

Traders receive and execute orders applying best execution practices

We trade through several brokers to ensure best price and service

-

Monitoring

Portfolio monitoring: The portfolio is actively monitored and rebalanced to reflect changing market conditions and ensure adherence to the guidelines

Risk Management: Regular performance measurement and attribution analysis are conducted to evaluate performance and minimize deviation from the mandate

-

Reporting

Monthly / Quarterly / Annual detailed portfolio performance reports are sent to the client that include performance, allocations, market commentary and analysis

Regular meetings with clients are conducted to give an update on developing market conditions and share the investment strategy for the portfolio